Buying a home is often the most significant financial transaction of a person’s life. It is a moment filled with excitement and anticipation, but unfortunately, it also carries a significant risk that has nothing to do with the property itself.

According to the FBI’s Internet Crime Complaint Center (IC3), real estate wire fraud and Business Email Compromise (BEC) are among the most financially damaging cybercrimes in the United States. In its 2023 Internet Crime Report, the FBI reported that BEC schemes resulted in over $2.9 billion in adjusted losses, a figure that continues to rise annually. In this digital age, the threat isn’t a burglar breaking into your new home; it is a cybercriminal breaking into the email chain of your transaction.

While most real estate agents focus primarily on the home’s aesthetics or on negotiating the price, my background demands a different approach. Before entering Real Estate as a career, I spent 25 years in Information Technology and Information Systems Security, as the Director of Information Technology, and most recently serving as the CIO at CrescentCare, a Federally Qualified Health Center (FQHC) located in New Orleans. I have seen the sophistication of modern cyber threats firsthand, and I bring that healthcare-grade security mindset to every real estate transaction I manage.

Why Real Estate Transactions Are the "Perfect Storm" for Hackers

Cybercriminals are opportunistic, and real estate closings provide the perfect environment for theft. There are three main reasons why hackers target home buyers and sellers:

High-Value Transfers: Real estate transactions involve large sums of money—often hundreds of thousands of dollars—being transferred in a single wire.

Publicly Available Data: Real estate listings are public. Hackers can easily monitor Multiple Listing Services (MLS) and pending home sales to identify exactly who is closing on a home and when.

Multiple Entry Points: Typically, a single transaction involves a buyer, seller, two agents, a lender, a title company, and inspectors. If just one of these parties has a compromised email account, the entire transaction is vulnerable.

The Threats You Need to Know About

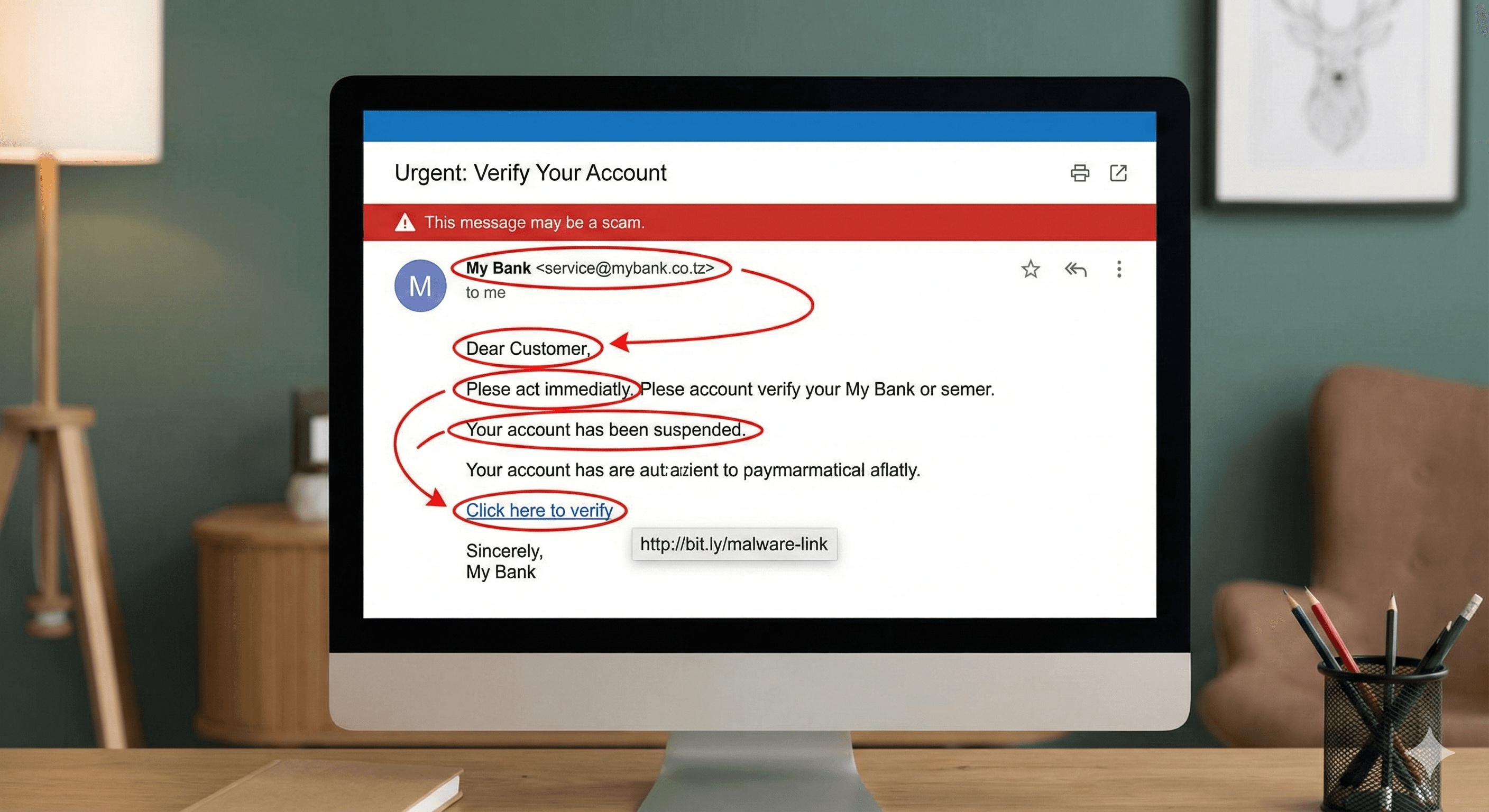

To protect yourself, you must understand the tactics criminals use. The most prevalent threat in our industry is Business Email Compromise (BEC).

In a BEC scam, hackers do not need to "hack" your bank account directly. Instead, they gain access to an email account belonging to a real estate agent, lender, or a title company officer. They quietly monitor the email correspondence, waiting for the closing date to approach.

The "Changed Wiring Instructions" Scam

This is the most devastating scenario for home buyers.

The Setup: You are days away from closing. You receive an email that looks exactly like it came from your title company or agent. The logo is correct, the tone is professional, and it references specific details about the property.

The Trap: The email claims there has been a "last-minute change" to the wiring instructions due to an audit or bank error. It provides new account details for your down payment.

The Result: If you wire the funds to that new account, the money goes directly to the hacker, often overseas, and is usually unrecoverable.

From Healthcare-Grade Security to Home Closing: My Approach

During my tenure as IT Director and then CIO at CrescentCare, protecting sensitive data wasn't just a policy—it was a mandate. In the healthcare sector, securing patient information (HIPAA compliance) against phishing attacks and data breaches is a 24/7 operation.

I witnessed the evolution of phishing scams from poorly written emails to highly sophisticated social engineering attacks. My team and I were responsible for identifying and intercepting countless phishing attempts, mitigating damage, and staying one step ahead of bad actors.

I have transferred this rigor to my real estate practice.

When you work with me, I do not simply trust that the other parties in the transaction are secure; I verify it. I vet the vendors and title companies we work with to ensure they utilize encrypted communication portals and multi-factor authentication. My experience helps me spot subtle red flags of compromised communication channels that others might miss.

How to Protect Yourself: A Client’s Checklist

While I work tirelessly to secure the perimeter of our transaction, client vigilance is the final line of defense. Here are the protocols I advise all my clients to follow:

Trust But Verify: Never trust an email containing wiring instructions, even if it appears to come from the title company or me. ALWAYS call the title company on a verified phone number (not the number listed in the suspicious email) to confirm the routing and account numbers before sending a dime.

Beware of Urgency: Cybercriminals rely on panic. If you receive a message pressuring you to "act immediately" or risk losing the house, STOP. This is a classic social engineering tactic.

Secure Portals Over Email: Whenever possible, avoid emailing sensitive documents like tax returns, bank statements, or Social Security numbers. We utilize secure transaction management platforms to keep your data encrypted.

Clean Cyber Hygiene: Ensure your own email account is checking for two-factor authentication (2FA). If your personal email is compromised, hackers can intercept the conversation from your end.

Conclusion

Technology has streamlined the home-buying process, making it faster and more efficient. However, it requires a level of vigilance that was unnecessary a decade ago.

You do not need to be a technology expert to stay safe, but it certainly helps to have a Realtor who is. By combining my 25 years of experience in Information Technology and Information Systems Security with my real estate expertise, I ensure that my clients’ life savings are treated with the same level of security as the critical data I protected for thousands of patients over the years.

Free Resource: Protect Your Digital Life

Security goes beyond the closing table. I have compiled a "Guide to Personal Cybersecurity" that outlines simple steps you can take to secure your personal finances, email, and identity.

CLICK HERE to sign up and receive your free Cybersecurity Guide

Ready to Buy or Sell with Confidence?

Don't leave your life's biggest investment to chance. If you are looking to buy or sell a home and want a partner who prioritizes your security as much as your success, contact me today.

References

Federal Bureau of Investigation. (2024). Internet Crime Report 2023. Internet Crime Complaint Center. https://www.ic3.gov/

National Association of Realtors. (2023). Wire fraud in real estate: A clear and present danger. https://www.nar.realtor/

Coalition to Stop Real Estate Wire Fraud. (n.d.). The state of wire fraud. https://stopwirefraud.org/